What's It's Like to Shop the Healthcare Marketplace

This article first appeared on Medium Dec. 2018

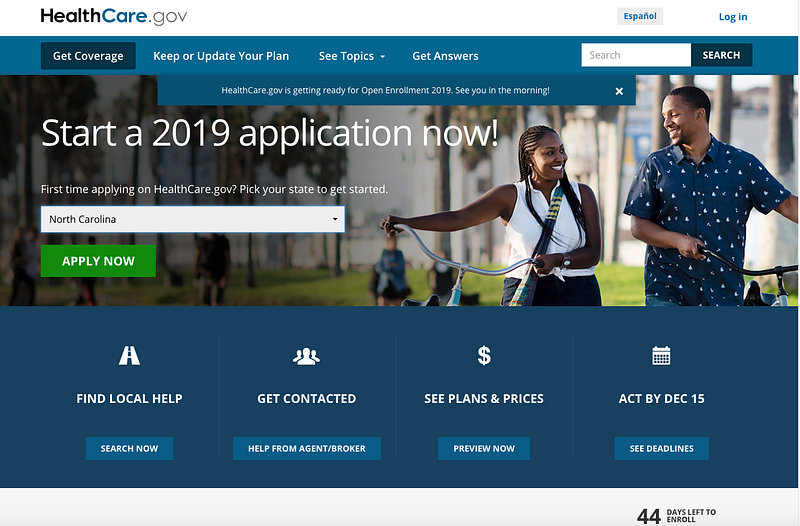

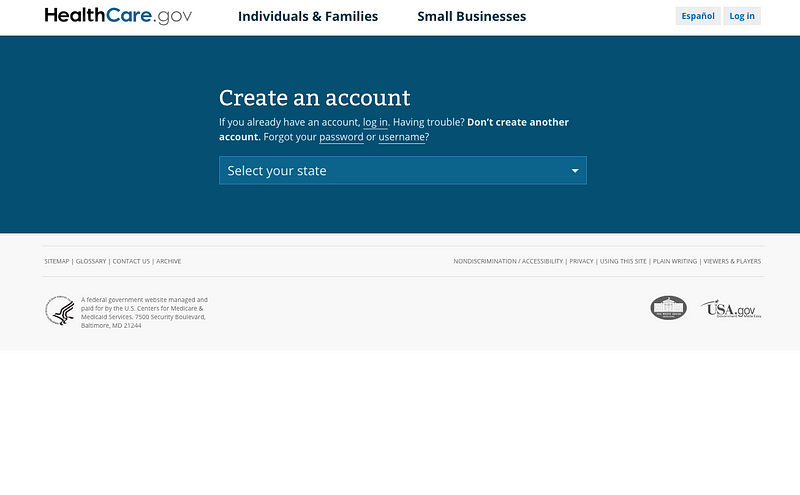

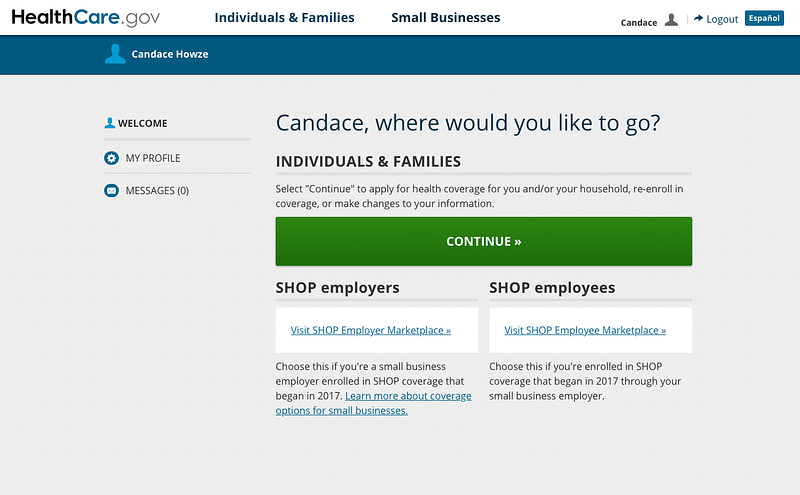

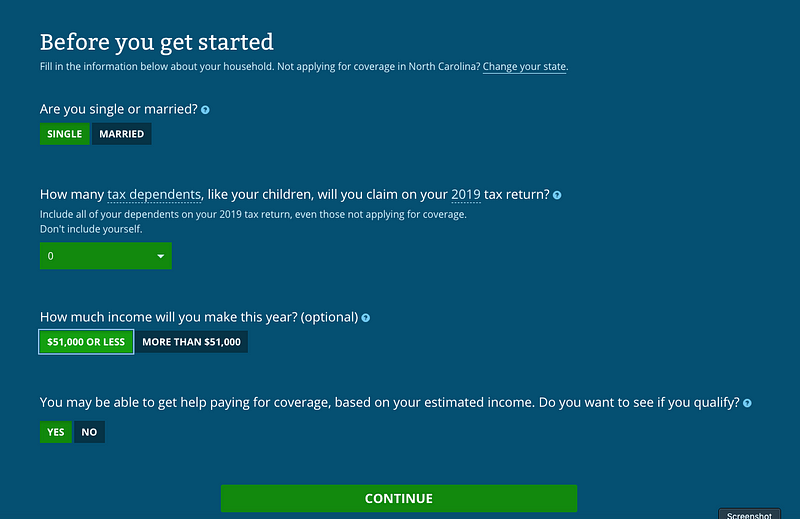

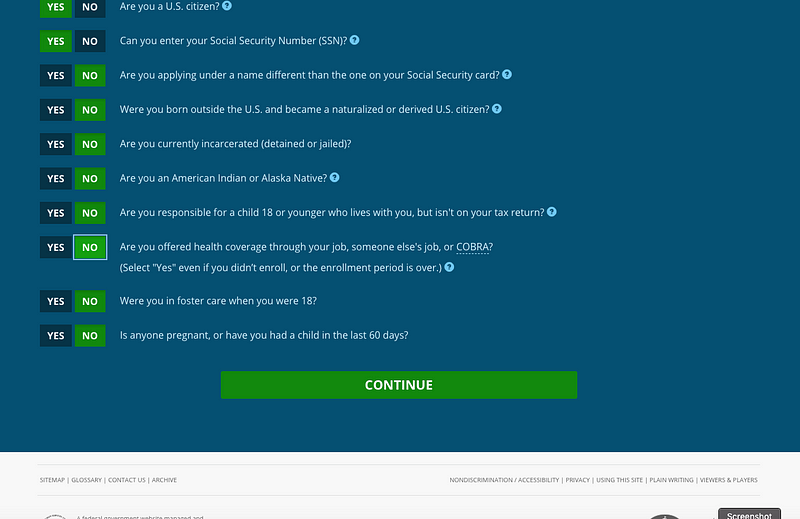

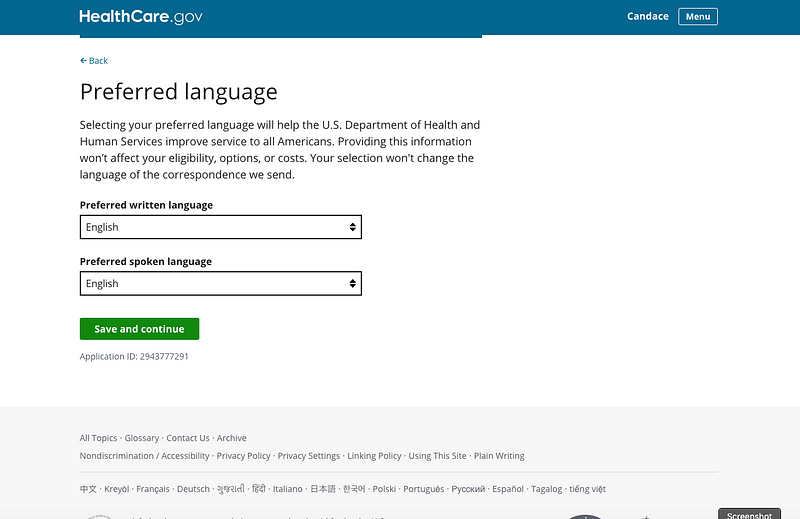

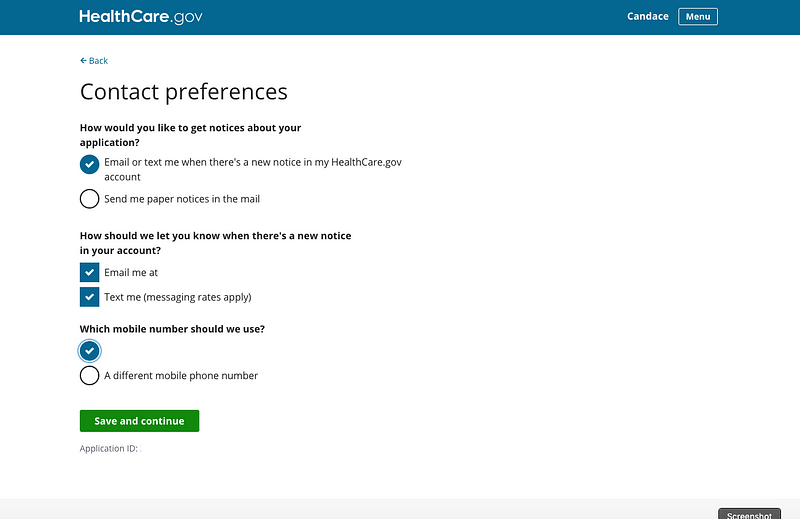

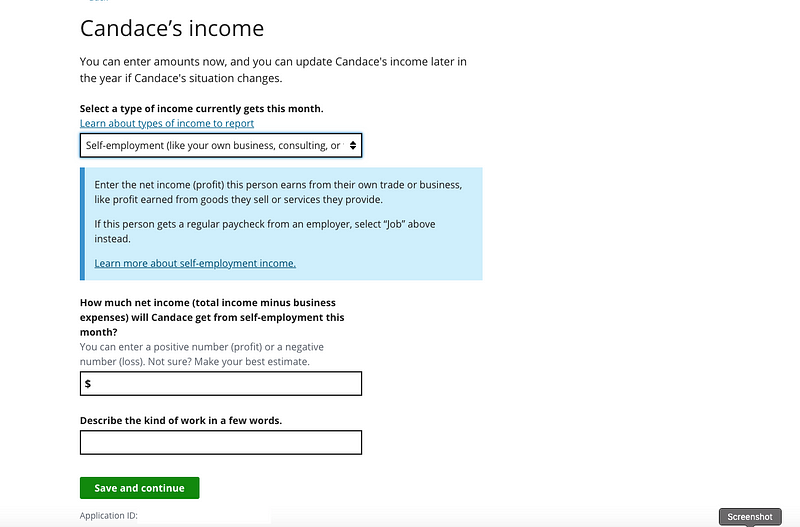

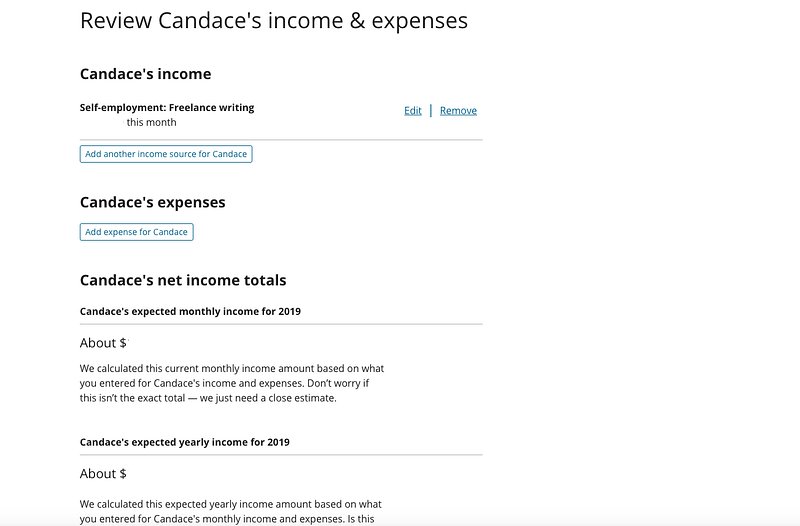

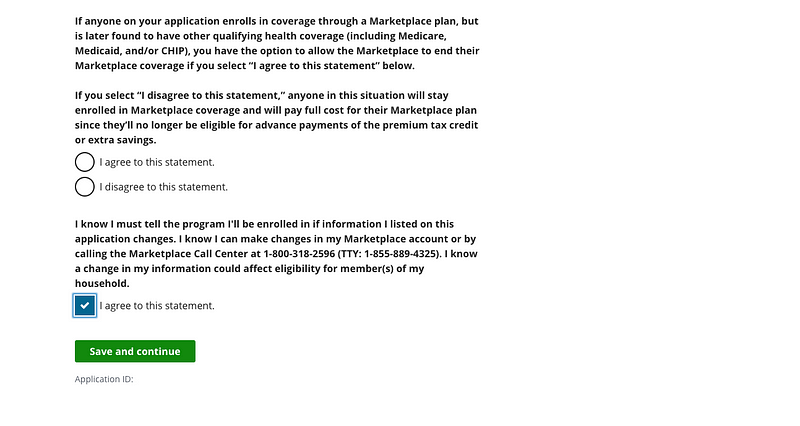

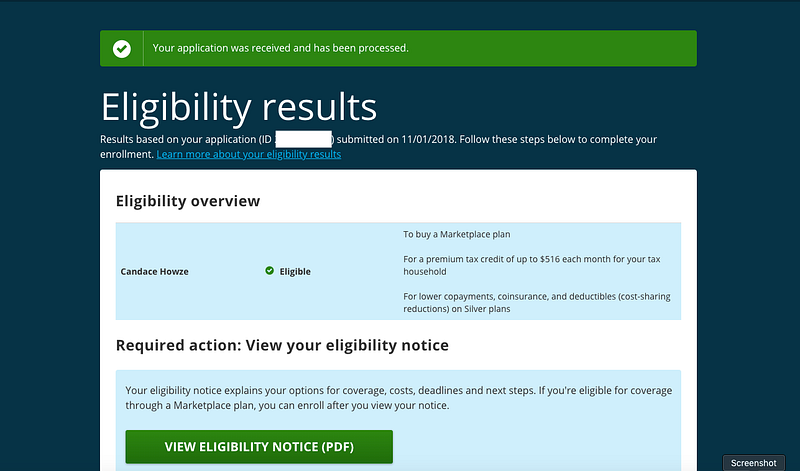

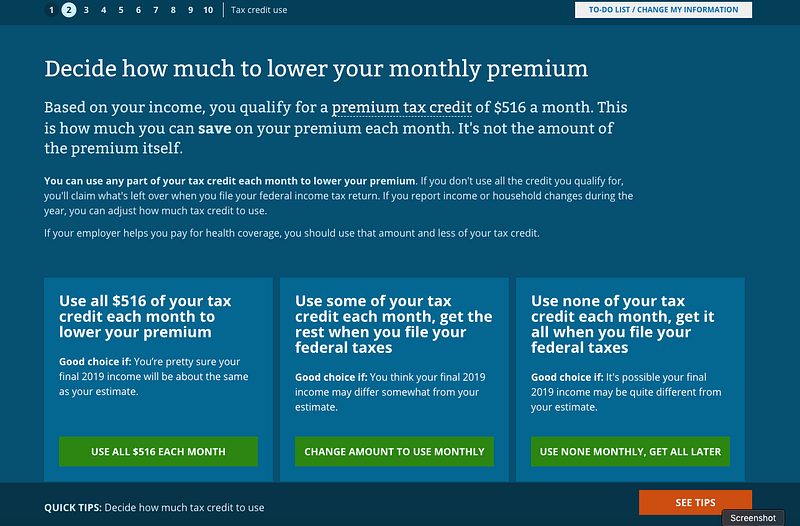

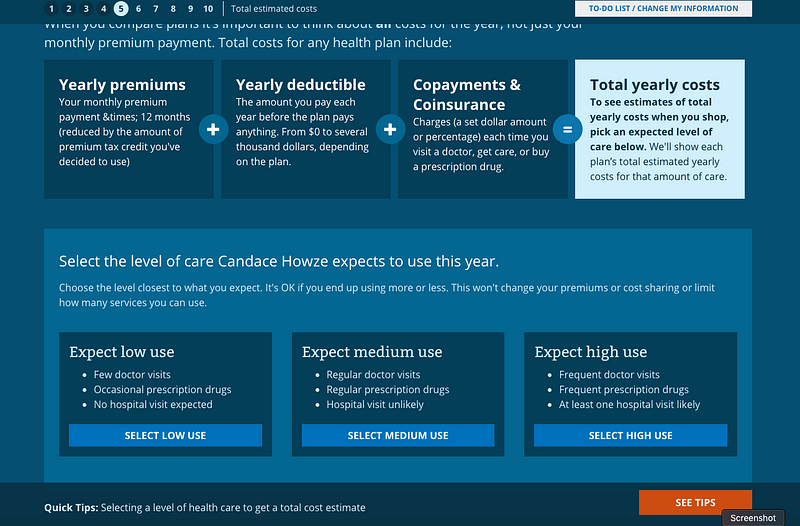

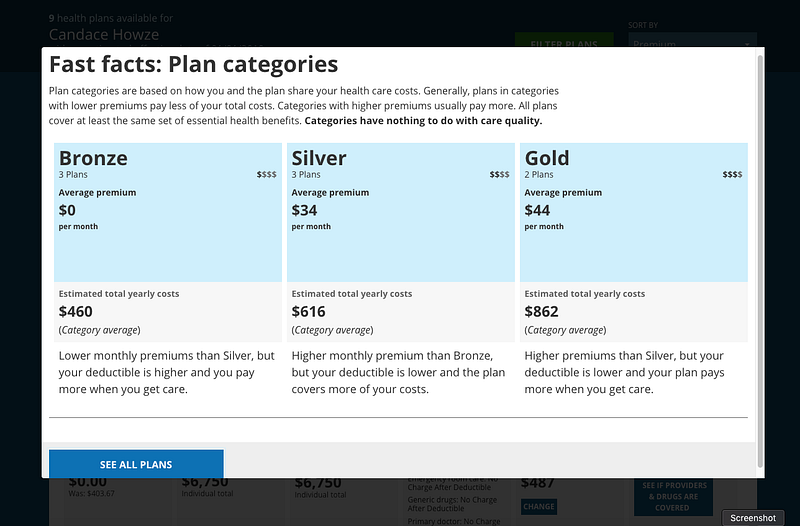

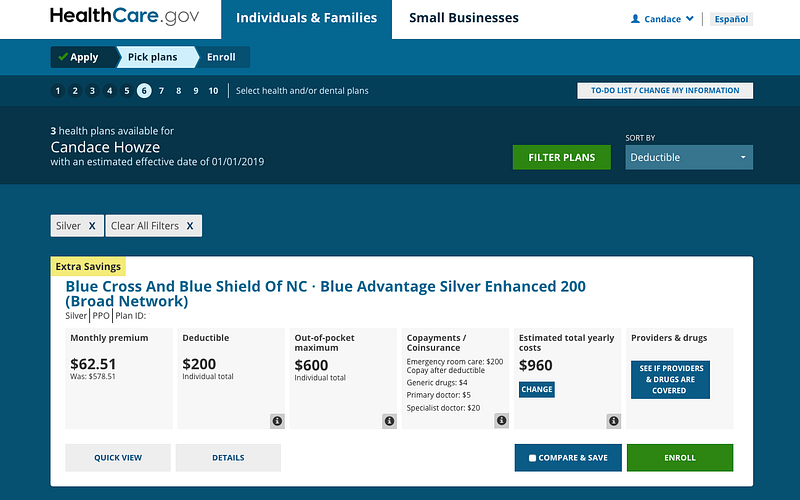

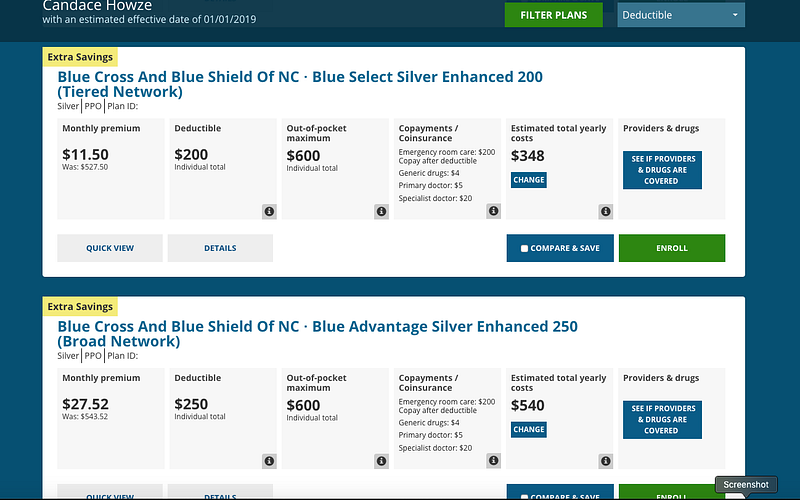

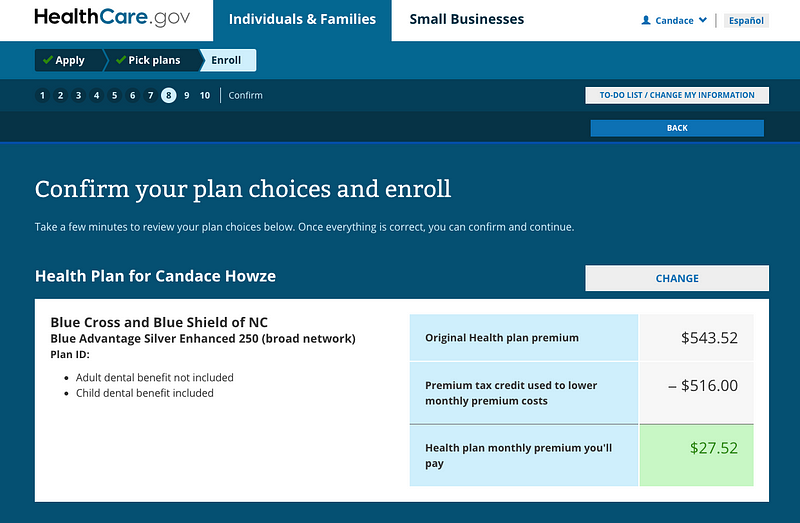

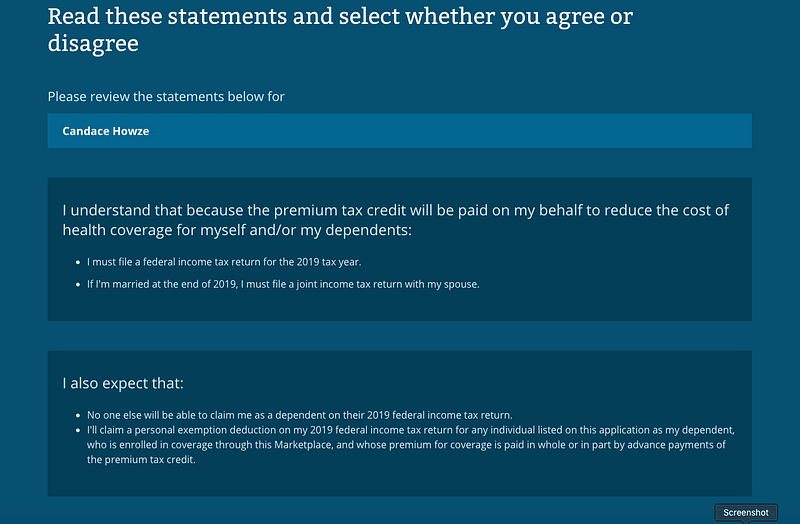

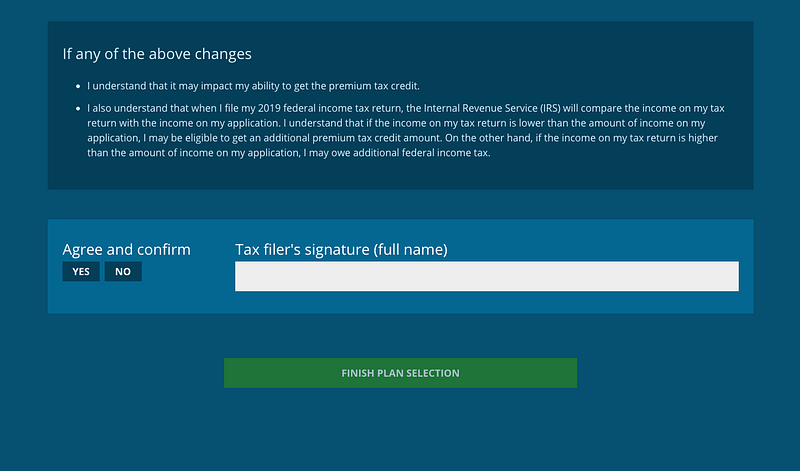

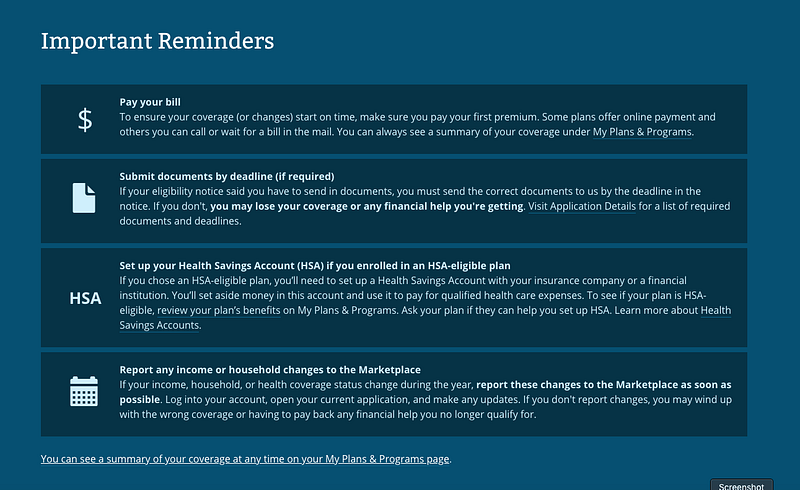

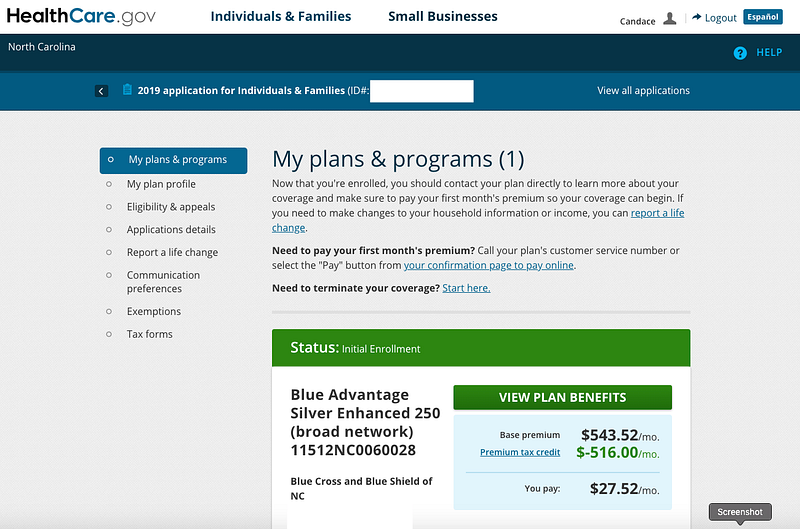

In many ways, I’m the typical millennial. I live at home. I work remote-based jobs. I travel and post pics on IG. And most importantly, I’m turning 26 and falling off my mom’s health insurance. The inevitable open enrollment looms and how is a self-employed young adult like myself going to afford the basic care it takes to stay healthy? I’m about to find out. In 2010 when the ACA (Affordable Care Act) passed, I clapped from the small corner of my bedroom and continued with college applications because the marketplace was still years away from being relevant to me at all. Now, as a millennial freelancer who religiously keeps my dental and well women’s exam appointments up to date on my mom’s insurance, healthcare is very important and suddenly–my responsibility. A few months out from my 26th birthday, I knew it was time to begin the Marketplace hunt for a plan to meet my needs. The question is, would it be affordable? Days before Open Enrollment began on Nov. 1st, I scouted out the regular healthcare market to see what was available for individual coverage in my home state of North Carolina. The quotes that came back were more like small car payments, ranging from $163/month to upwards of $600. I also had a few more emails and phone calls from greedy salesmen than I bargained for. The less expensive plans were largely temporary plans that you can only have for a few months up to a year. They’re ideal for young adults who are transitioning to their own insurance or in between jobs and need to be covered during a short gap period. Many cover a few basic services, but don’t qualify as a full comprehensive plan as mandated by the ACA. It was during this period that I would find a decently-priced plan only to realize there was something drastically missing: no co-pay for simple routine checkups, little options for deductibles or no prescription coverage. It seemed impossible to find a plan that covered my basic needs: small co-pay for checkups, discount on basic prescriptions if I need one, reasonable deductibles, copay for mental health services, and a reasonable 70–30 coverage split on most other services. The ideal situation would be a nice a la carte approach to insurance, but that’s far from being a reality. Seeing how large the premiums are for one individual plan made it clear why the marketplace was so necessary, but I wasn’t sure how affordable it would be. When you purchase healthcare through the marketplace, you can claim a subsidy from the federal government to help cover the costs of your premium. This is especially important for independent contractors like myself, who often experience variable and unpredictable salaries. The catch is that not everyone is eligible for subsidies. The overall range for receiving a subsidy is anywhere from approximately $12,000-$50,000 a year for a single person. If you make more than $50k there’s not much help in covering your premium cost. If you make less than that bottom number, there’s no subsidy for you either. This may be perplexing considering there’s no way you can afford paying $400 a month for insurance. Instead, the government recommends that you apply for Medicaid–if it’s available in your state as an option for low-income individuals. Once I determined that I fit in the subsidy range, I opted to enter the marketplace once Open Enrollment commenced. Here’s what to expect step-by-step from the application and how to estimate and report your income as a freelancer (there’s no mobile app yet to apply for insurance but hopefully that’s on the future radar). The first thing you will do is click the front page option on www.healthcare.gov to apply for the marketplace. You’ll choose your state and create an account with a username and password as with any online account if you don’t already have one. Once you’re logged in, you’ll see this welcome page with a large, friendly green button that directs you straight to the application. You’ll answer a few preliminary questions that determine whether or not you may be eligible for a tax credit. Complete a few more simple Yes or No questions. Choose your preferred language. Choose whether you prefer digital or paper communication. Choose your income type and enter the amount of money you made in wages this month. The marketplace is extremely understanding of individuals with non-traditional income. You report self-employment income by providing your best estimate of your annual income for the year you are applying for coverage (in this case 2020. You don’t have to provide anything to prove this amount. Just do your best based on what you currently know about your job and what you anticipate. If anything drastically changes over the coverage year (you lose employment, switch jobs, or drastically increase your income) you can log in and report the changes and you are advised to do so within 30 days of the change. The system will estimate your 2020 income based on the number you entered and ask if this is correct. You will choose what happens if you are found to have other qualifying coverage and continue the application. Congratulations! At this stage, your application is processing, and you can now see your healthcare eligibility. You have the choice to use all of your tax credit, some of it or none of it. The choice is completely yours. You will indicate what kind of medical care you expect to use. There’s lots of helpful tips and pop-up windows you can click along the way that explain things such as plan categories and what the levels of coverage mean. You can even search plans by category, which I did, choosing to view Silver plans only. You will see a list of plans available to you with your price after the subsidy. You can click to view entire plan details, compare plans and more. Once you’ve looked at your options and are ready to choose one, simply click Enroll. Are you sure? Click yes or no. You will see a summary of your plan and costs. Here, it reminds me that dental is not covered, which isn’t a problem because BCBS offers dental packages that are only $40/month for individuals and are accepted by the majority of dental professionals in the state. The marketplace will ask if you’d like to view dental plans on their site, which you can do to see your options. Agree to the terms and remember that you will be required to file a tax return. Type in your name to sign and confirm your choices. At this point, you’ll pay your first premium to officially enroll in your insurance. You can also simply continue and pay your first premium at a later date. These are important reminders. And you’re all done! This is what your home page will look like after completing the application. Often the marketplace can initiate other healthcare communication like prescription card programs or even Medicaid applications, all of which I received in the mail weeks after my application was submitted. Don’t let this confuse you! As long as you have accurately completed your marketplace application you won’t have anything to worry about. If you’re turning 26 soon and don’t have healthcare through an employer, make sure you apply before December 15th. There are also special enrollment periods that bracket a period of time before and after your 26th birthday in which you can enroll. For example, if you turn 26 next August, you’ll be able to apply for healthcare about a month or so before and after your birthday. That means all you have to do now is renew on your parent's insurance and you'll be covered through the end of your birthday month. There’s information about all of these dates on www.healthcare.gov. Overall, the process of finding insurance through the Marketplace was pretty painless and I had comprehensive healthcare for $25 a month out of pocket. In the middle of the year when my income increased, I reported the change and they adjusted my subsidy accordingly. It's crucial that you update soon so you won't be left owing subsidy dollars when you file taxes. Once you've chosen a Marketplace plan, you don't have to do anything special to renew it each year.

The Marketplace is open now until Dec 15th. What has your experience with the healthcare marketplace been like? Let me know in the comments. Have questions? Drop them below.